[ad_1]

52-Week Cash Problem Defined

On the subject of the brand new 12 months, many individuals wish to begin embracing change and growing new habits. In actual fact, 27 % of adults within the U.S. made no less than one decision for 2020, and 44 % of these individuals had “saving extra money” as one in every of them.

One approach to fulfill a New 12 months’s decision is to set achievable targets for your self and preserve observe of your progress. There are many challenges to choose from if you wish to get monetary savings throughout the brand new 12 months. For those who’re up for a problem that doesn’t require some huge cash and energy every month however nonetheless saves you $1,378 on the finish of the 12 months, the 52-week cash problem could be simply best for you.

What Is the 52-Week Cash Problem?

The 52-week cash problem is a financial savings problem by which you deposit an growing sum of money each week for 52 weeks. On the finish of the 52 weeks, it is best to have no less than $1,378 saved up in your checking account. This can be a versatile problem that may be finished in a few alternative ways and even permits you to save extra in case you determine to deposit a bigger quantity every week.

Mostly, the greenback quantity you save each week corresponds to the week of your problem. For example, you put aside $1 throughout week one, $5 throughout week 5, $39 throughout week 39, and so forth.

When Is the Greatest Time to Begin the 52-Week Cash Problem?

The wonderful thing about the 52-week financial savings problem is you could primarily begin it at any week you’d like. However in order for you it to be a part of your New 12 months’s decision, beginning it throughout the first week of the 12 months will assure you no less than $1,378 by the final week of the 12 months — in case you comply with it correctly.

How Does the 52-Week Cash Problem Work?

For this problem, the quantity it is best to deposit is often the identical because the variety of the week within the problem. Right here’s how the financial savings problem works:

- Beginning on week one, deposit $1 to a financial savings account

- On week two, it is best to deposit $2

- On week three, deposit $3

- On week 4, deposit $4, and so forth

- Deposit till week 52, when you’ll deposit $52

Straightforward, proper? Depositing an growing sum of money every week makes it an attainable purpose to attain $1,378 on the finish of the final week. Every time you make a deposit, write down your present whole financial savings to maintain you on observe and motivated.

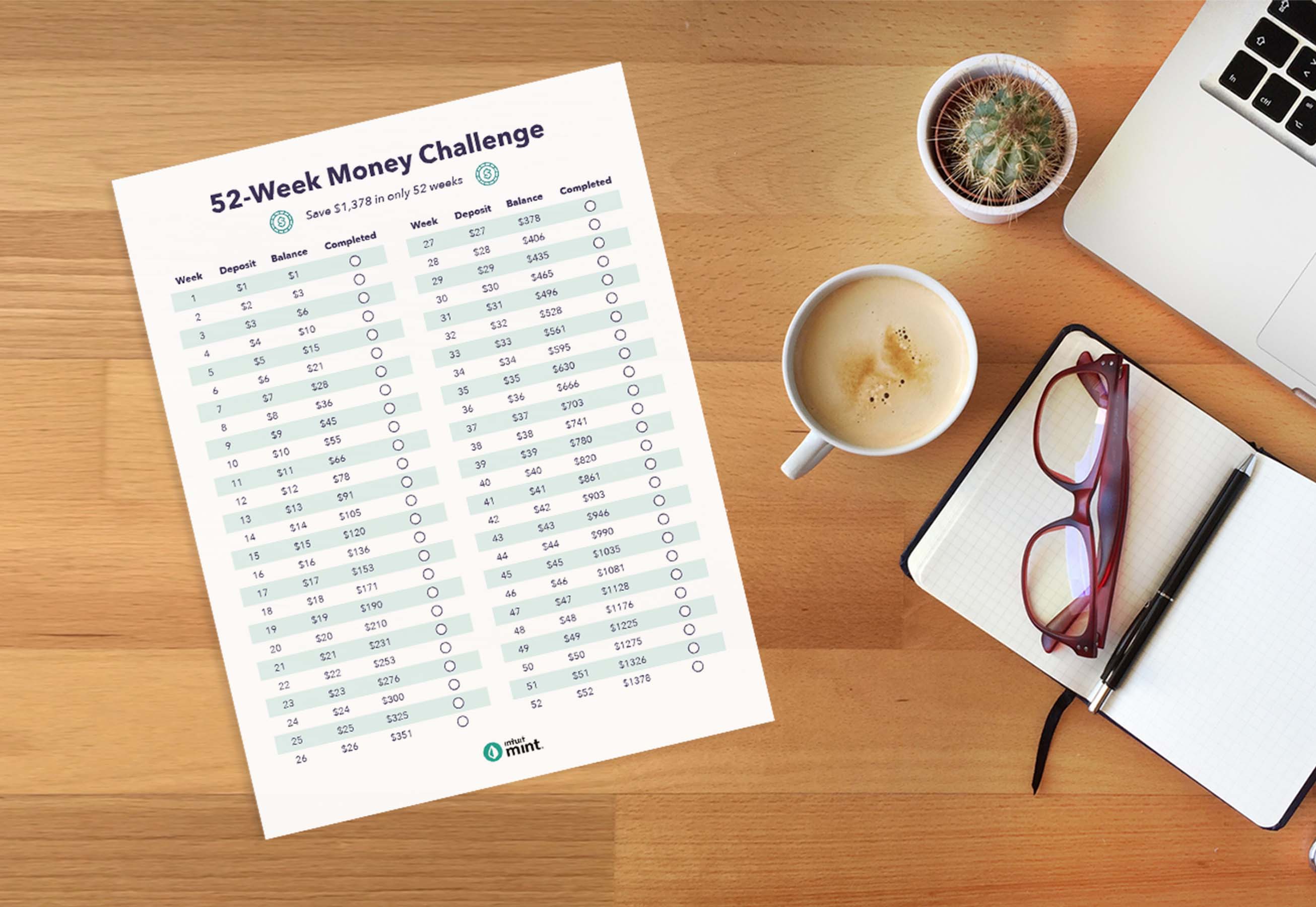

Here’s a money-saving chart that will help you perceive how a lot cash you need to be depositing every week throughout the 52-week cash problem:

| Week | Weekly Deposit | Complete Financial savings |

|---|---|---|

| Week 1 | $1 | $1 |

| Week 2 | $2 | $3 |

| Week 3 | $3 | $6 |

| Week 4 | $4 | $10 |

| Week 5 | $5 | $15 |

| Week 6 | $6 | $21 |

| Week 7 | $7 | $28 |

| Week 8 | $8 | $36 |

| Week 9 | $9 | $45 |

| Week 10 | $10 | $55 |

| Week 11 | $11 | $66 |

| Week 12 | $12 | $78 |

| Week 13 | $13 | $91 |

| Week 14 | $14 | $105 |

| Week 15 | $15 | $120 |

| Week 16 | $16 | $136 |

| Week 17 | $17 | $153 |

| Week 18 | $18 | $171 |

| Week 19 | $19 | $190 |

| Week 20 | $20 | $210 |

| Week 21 | $21 | $231 |

| Week 22 | $22 | $253 |

| Week 23 | $23 | $276 |

| Week 24 | $24 | $300 |

| Week 25 | $25 | $325 |

| Week 26 | $26 | $351 |

| Week 27 | $27 | $378 |

| Week 28 | $28 | $406 |

| Week 29 | $29 | $435 |

| Week 30 | $30 | $465 |

| Week 31 | $31 | $496 |

| Week 32 | $32 | $528 |

| Week 33 | $33 | $561 |

| Week 34 | $34 | $595 |

| Week 35 | $35 | $630 |

| Week 36 | $36 | $666 |

| Week 37 | $37 | $703 |

| Week 38 | $38 | $741 |

| Week 39 | $39 | $780 |

| Week 40 | $40 | $820 |

| Week 41 | $41 | $861 |

| Week 42 | $42 | $903 |

| Week 43 | $43 | $946 |

| Week 44 | $44 | $990 |

| Week 45 | $45 | $1,035 |

| Week 46 | $46 | $1,081 |

| Week 47 | $47 | $1,128 |

| Week 48 | $48 | $1,176 |

| Week 49 | $49 | $1,225 |

| Week 50 | $50 | $1,275 |

| Week 51 | $51 | $1,326 |

| Week 52 | $52 | $1,378 |

Easy methods to Alter the 52-Week Cash Problem for Your Funds

The 52-week problem can be adjusted relying in your targets or monetary habits. For example, it’s also possible to begin from the very best quantity, and deposit a reducing sum of money every week. Or you may select to deposit the identical quantity each week.

From Lowest to Highest Quantity

The bottom to highest quantity methodology is the standard 52-week cash problem. You’ll begin with $1 and deposit an growing sum of money every week till the top of week 52, totaling as much as $1,378.

From Highest to Lowest Quantity

For those who consider you can be spending extra towards the top of the 12 months, maybe as a result of holidays, you may flip the 52-week cash problem by depositing your highest quantities first. On this methodology, you’ll begin with the very best quantity, $52 at week one, and deposit a reducing quantity every week. So on week 52, you’ll deposit $1, nonetheless totaling as much as $1,378.

Save $26.50 Every Week

If you wish to make issues even simpler, this no-brainer methodology nonetheless totals $1,378 on the finish of the 12 months. By utilizing this methodology, you’ll deposit the identical quantity every week: $26.50. You too can arrange automated transfers each week — that means, you don’t have to fret about making completely different deposits every week.

Easy methods to Be Profitable within the 52-week cash problem

Beginning this problem ought to be simple. In spite of everything, you’re solely beginning with a $1 deposit. The wrestle many individuals face with cash challenges is maintaining with them. To be sure you’re profitable within the 52-week cash problem, comply with these tricks to keep on observe:

Have a Objective in Thoughts

All of us want a bit of motivation with regards to attaining resolutions. Begin the problem with an finish purpose in thoughts and set reminders for your self all through the method. Having a purpose reminiscent of saving up for a trip or growing your emergency fund will provide help to keep motivated throughout the problem.

Add It to Your Funds

To make sure that you’re on observe along with your problem every month and come up with the money for accessible for it, you may add it to your weekly price range. For those who use a budgeting app, add the quantity that might be going to your financial savings account every week.

You too can use our printable of the 52-week cash problem that will help you keep on observe. You’ll be able to set a reminder so as to add cash to the problem every week, or arrange an automated switch to your financial savings account.

Reduce Again on Bills

To be sure you’re profitable on this problem, contemplate chopping again on some bills you’ve gotten every week. This additionally helps with monetary data as you begin constructing wholesome spending habits.

Check out your present price range and consider if there are any bills which can be ignored. Pay further consideration to subscription providers you now not use or whether or not you’re overspending on meals supply providers. That is additionally a possibility to promote gadgets you don’t use anymore for further money.

Hold Your Financial savings Problem Cash in a Separate Account

As a result of this problem lasts an entire 12 months, it could be tempting to make use of the problem funds when shopping for groceries or having dinner with pals sooner or later. To stop that from occurring, preserve the funds in a separate account, ideally a high-yield financial savings account.

You’ll be able to open a financial savings account strictly for this problem, or in case you really feel extra motivated through the use of money, retailer it in a protected place. Having the problem cash in a separate account may also provide help to preserve observe of it.

Advantages of the 52-Week Financial savings Problem

Whether or not you determine to strive it out, skip a few weeks, and even find yourself not ending it, there are nonetheless some advantages and classes you may take away from the 52-week cash problem:

- Begin a behavior of saving constantly

- Get motivated to check out different challenges

- Study extra about your monetary targets

- Enhance your private funds

- Monitor your weekly price range

- Save no less than $1,378!

For those who determine to not full the problem, you should use it as a studying alternative to enhance your funds and take a look at one other problem that matches your life-style higher. Nevertheless, in case you end the problem, you’ll have constructed up some financial savings you could make investments or use to start out an emergency fund — or you may preserve the problem going for one more 12 months to save lots of much more.

Associated

[ad_2]

Leave a Reply