[ad_1]

In the case of constructing one of the best funding portfolio, you’ll typically hear that diversification is essential. However what does that even imply — and why do it’s essential trouble with it? In any case, you already personal a variety of shares, from that skyrocketing Amazon inventory to your Apple and eBay shares, and also you’re raking within the earnings. What might go flawed?

In case you’re counting on a portfolio stuffed with massive tech shares or vitality shares to get you thru to retirement — or for those who’re banking on choosing the right shares endlessly — you might be in for a shock through the subsequent market downturn. It’s fairly simple to select the “proper” shares with the market is overvalued. However, when a market correction occurs, you’re most likely going to be wishing you’d paid extra consideration to the recommendation about diversification.

If you wish to construct wealth and make the proper strikes on your investments, it’s essential construct a diversified portfolio.

What’s diversification?

Have you ever ever heard the saying, “Don’t put all of your eggs in a single basket?” That’s the identical precept that drives buyers to diversify their investments.

While you diversify your investments, you unfold your cash out throughout totally different funding choices to decrease the chance that comes with investing. In different phrases, buyers use diversification to keep away from the large losses that may occur by placing all of their eggs in a single basket.

For instance, whenever you diversify, you allocate a portion of your investments to riskier inventory market buying and selling, which you unfold out throughout several types of shares and corporations. When diversifying, you additionally put cash into safer investments, like bonds or mutual funds, to assist stability out your portfolio.

The concept behind diversification is that you just keep away from counting on one sort of funding or one other. When considered one of your investments takes a tumble, the others act as a life raft on your cash, offering stable returns till the riskier investments stabilize.

Why is diversification essential?

An absence of diversification may cause massive hassle on your cash. That’s as a result of:

- Investing with the primary objective of being profitable instantly is a straightforward solution to lose. Something can occur sooner or later. Shares tumble, markets crash, and fluctuations and corrections occur.

- It’s not sufficient to diversify the kinds of shares you put money into, both. You need to deal with several types of shares, not simply tech or vitality shares, but when the entire market takes a downward flip, or if a correction occurs, you want different investments to assist stability it out.

- Having a wide range of investments in your portfolio is the one solution to stability out market downturns. In case you don’t diversify, you’re banking on the concept your investments will at all times pan out the way in which you need them to. And, for those who ask any seasoned investor, that’s not one of the best plan.

Let’s say that you just suppose tech shares are the longer term. The tech trade is rising at a monumental tempo, and also you’ve been fortunate along with your tech inventory purchases to date. So, you are taking all your funding cash and also you dump it into shopping for inventory for large-cap tech firm shares.

Now let’s say that the tech shares have a steep uphill trajectory, making you tons of cash in your funding. A couple of months later, although, dangerous information in regards to the tech sector makes headlines, and it causes your cash-machine shares to plunge, dropping you tons of cash within the course of. What recourse do you will have apart from to promote at a loss or maintain and hope they recuperate?

Now, let’s say you invested closely in large-cap tech shares, however you additionally invested in small-cap vitality shares or medium-cap retail shares, in addition to some mutual funds, to stability it out. Whereas the opposite kinds of investments have decrease returns, they’re additionally constant.

When your sure-thing tech shares take a nosedive, your safer investments assist to guard you with ongoing returns, and you’ll higher afford the losses from the riskier investments you made. That’s why diversification is essential. It protects your cash whereas letting you make riskier investments in hopes of larger rewards.

Diversification breakdown by age

Diversification is essential at any age, however there are occasions when you may and must be riskier with what you put money into. In actual fact, most cash specialists encourage youthful buyers to focus closely on riskier investments after which shift to much less dangerous investments over time.

The rule of thumb is that you need to subtract your age from 100 to get the proportion of your portfolio that you need to preserve in shares. That’s as a result of the nearer you get to retirement age, the much less time it’s a must to bounce again from inventory dips.

For instance, whenever you’re 45, you need to preserve 65% of your portfolio in shares. Right here’s how that breaks down by decade:

- 20-year-old investor: 80% shares and 20% “safer” investments, like mutual funds or bonds

- 30-year-old investor: 70% shares and 30% “safer” investments, like mutual funds or bonds

- 40-year-old investor: 60% shares and 40% “safer” investments, like mutual funds or bonds

- 50-year-old investor: 50% shares and 50% “safer” investments, like mutual funds or bonds

- 60-year-old investor: 40% shares and 60% “safer” investments, like mutual funds or bonds

- 70-year-old investor: 30% shares and 70% “safer” investments, like mutual funds or bonds

Diversification vs. asset allocation

Whereas asset allocation and diversification are also known as the identical factor, they aren’t. These two methods each assist buyers to keep away from big losses inside their portfolios, and so they work in a similar way, however there’s one massive distinction. Diversification focuses on investing in plenty of other ways utilizing the identical asset class, whereas asset allocation focuses on investing throughout a variety of asset lessons to minimize the chance.

While you diversify your portfolio, you deal with investing in only one asset class, like shares, and also you go deep inside the class along with your investments. That might imply investing in a variety of shares which have large-cap shares, mid-cap shares, small-cap shares, and worldwide shares — and it might imply various your investments throughout a variety of several types of shares, whether or not these are retail, tech, vitality, or one thing else totally — however the important thing right here is that they’re all the identical asset class: shares.

Asset allocation, then again, means you make investments your cash throughout all classes or asset lessons. Some cash is put in shares and a few of your funding funds are put in bonds and money — or one other sort of asset class. There are a number of kinds of asset lessons, however the extra widespread choices embrace:

- Shares

- Mutual funds

- Bonds

- Money

There are additionally various asset lessons, which embrace:

- Actual property, or REITs

- Commodities

- Worldwide shares

- Rising markets

When utilizing an asset allocation technique, the hot button is to decide on the proper stability of high- and low-risk asset lessons to put money into and allocate the proper proportion of your funds to minimize the chance and improve the reward. For instance, as a 30-year-old investor, the rule of thumb says to speculate 70% in riskier investments and 30% in safer investments to make sure you’re maximizing threat vs. reward.

Nicely, you could possibly allocate 70% of your funding to a mixture of riskier investments, together with shares, REITs, worldwide shares, and rising markets, spreading that 70% throughout all some of these asset lessons. The opposite 30% ought to go to much less dangerous investments, like bonds or mutual funds, to minimize the chance of losses.

As with diversification, the rationale that is completed is that sure asset lessons will carry out in another way relying on how they reply to market forces, so buyers unfold their investments throughout asset allocations to assist shield their cash from downturns.

Parts of a well-diversified portfolio

In an effort to have a well-diversified portfolio, it’s essential to have the proper income-producing belongings within the combine. The very best portfolio diversification examples embrace:

Shares

Shares are an essential element of a well-diversified portfolio. While you personal inventory, you personal part of the corporate.

Shares are thought-about riskier than different kinds of investments as a result of they’re unstable and might shrink in a short time. If the worth of your inventory drops, your funding may very well be value much less cash than you paid if and whenever you determine to promote it. However, that threat may repay. Shares additionally supply the chance for increased development over the long run, which is why buyers like them.

Whereas shares are a few of the riskiest investments, there are safer options. For instance, you may go for mutual funds as a part of your technique. While you personal shares in a mutual fund, you personal shares in an organization that buys shares in different firms, bonds, or different securities. Your entire objective of a mutual fund is to minimize the chance of inventory market investing, so these are usually safer than different funding sorts.

Bonds

Bonds are additionally used to create a well-diversified portfolio. While you purchase a bond, you’re lending cash in change for curiosity over a set period of time. Bonds are usually thought-about safer and fewer unstable as a result of they provide a set price of return. And, they’ll act as a cushion towards the ups and downs of the inventory market.

The draw back is that the returns are decrease, and are acquired over a longer-term. That mentioned, there are alternatives, like high-yield bonds and sure worldwide bonds, that supply a lot increased yields, however they do include extra threat.

Money

Money is one other element of a stable portfolio, and it contains liquid cash and the cash that you’ve in your checking and financial savings accounts, in addition to certificates of deposit, or CDs, and financial savings and treasury payments. Money is the least unstable asset class, however you pay for the security of money with decrease returns.

Further parts of diversification

There are different parts of diversification, too. As with the opposite asset lessons, these various belongings are utilized by some buyers to additional shield their portfolios. These embrace:

Actual property or REITs

You can even use actual property funds, together with actual property funding trusts (REITs), to diversify your portfolio and supply safety towards the dangers of different kinds of investments. Actual property funds work equally to mutual funds, however moderately than investing in an organization that buys shares in bonds, shares, and different widespread securities, you’re investing in an organization that owns, operates, or funds income-generating actual property, like multi-unit flats or rental properties.

Asset allocation funds

An asset allocation fund is a fund that’s constructed to supply buyers a diversified portfolio of investments that’s unfold throughout varied asset lessons. In different phrases, these funds are already diversified for buyers, so that they’re typically the one fund obligatory for buyers to have a diversified portfolio.

Worldwide shares

Buyers even have the choice of investing in worldwide shares to diversify their portfolios. These shares, issued by non-U.S. firms, can supply big potential returns, however as with every different funding that provides the potential for an enormous payoff, they can be extraordinarily dangerous.

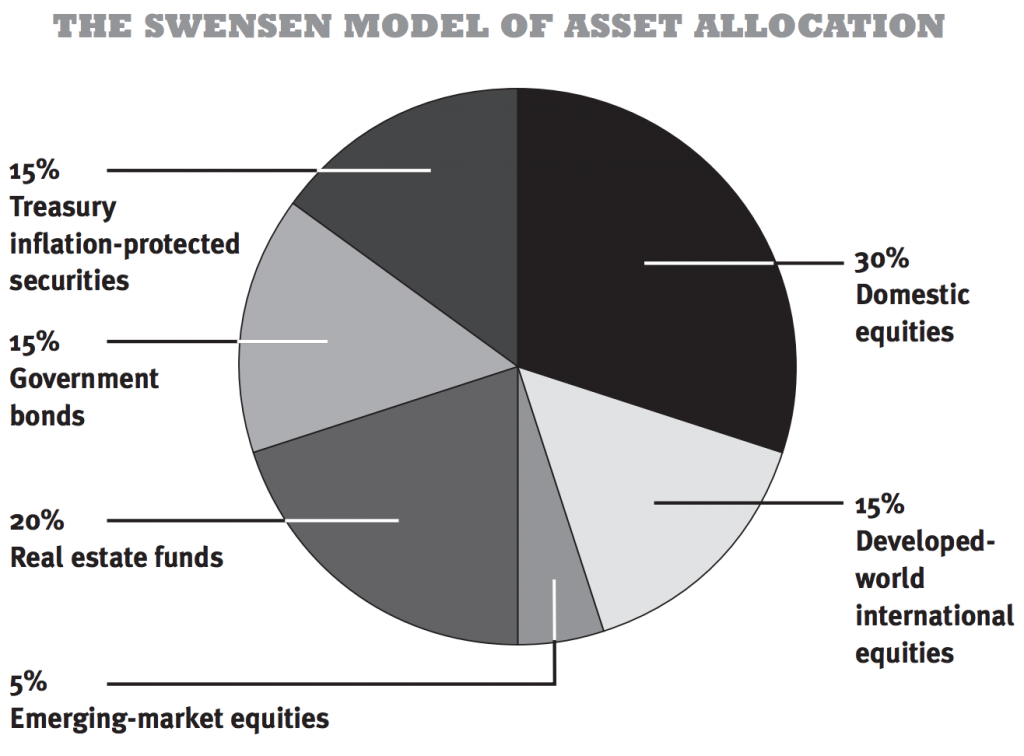

Diversified portfolio instance #1: The Swensen Mannequin

Only for enjoyable, we need to present you David Swensen’s diversified portfolio. David runs Yale’s fabled endowment, and for greater than 20 years he generated an astonishing 16.3% annualized return — whereas most managers can’t even beat 8%. Which means he’s DOUBLED Yale’s cash each four-and-a-half years from 1985 to at this time, and his portfolio is above.

David is the Michael Jordan of asset allocation and spends all of his time tweaking 1% right here and 1% there. You don’t want to try this. All it’s essential do is think about asset allocation and diversification in your personal portfolio, and also you’ll be means forward of anybody making an attempt to “decide shares.”

His wonderful suggestion for how one can allocate your cash:

| ASSET CLASS | % BREAKDOWN |

| Home equities | 30% |

| Actual property funds | 20% |

| Authorities bonds | 15% |

| Developed-world worldwide equities | 15% |

| Treasury inflation-protected securities | 15% |

| Rising-market equities | 5% |

| TOTAL | 100% |

What do you discover about this asset allocation?

No single alternative represents an amazing a part of the portfolio.

As illustrated by the tech bubble burst in 2001 and likewise the housing bubble burst of 2008, any sector can drop at any time. When it does, you don’t need it to pull your whole portfolio down with it. As we all know, decrease threat usually equals decrease reward.

BUT the good factor about asset allocation is that you would be able to really scale back threat whereas sustaining a stable return. For this reason Swensen’s mannequin is a good diversified portfolio instance to base your portfolio on.

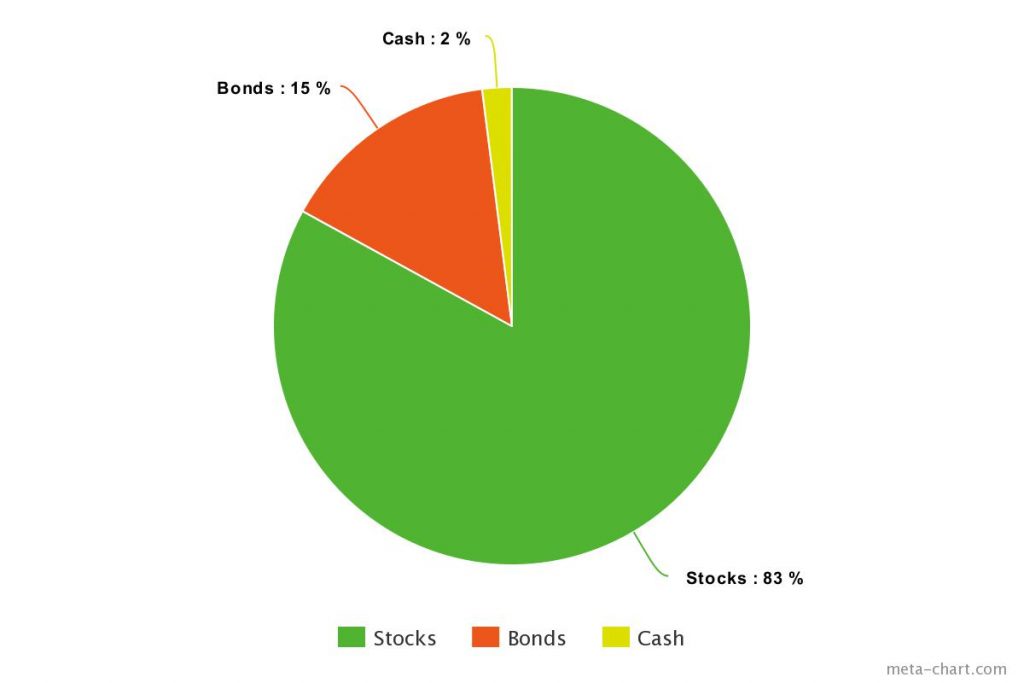

Diversified portfolio instance #2: Ramit Sethi’s diversified portfolio instance

That is our founder, private finance professional Ramit Sethi’s funding portfolio.

The asset lessons are damaged down like this:

| ASSET CLASS | % BREAKDOWN |

| Money | 2% |

| Shares | 83% |

| Bonds | 15% |

| TOTAL | 100% |

Listed here are three items of context so that you perceive the WHY behind the numbers:

Lifecycle funds: The muse for my portfolio

For most individuals, Ramit advocate nearly all of investments go in lifecycle funds (aka target-date funds).

Bear in mind: Asset allocation is all the things. That’s why Ramit picks largely target-date funds that robotically do the rebalancing for him. It’s a no brainer for somebody who:

- Loves automation.

- Doesn’t need to fear about rebalancing a portfolio on a regular basis.

They work by diversifying your investments for you based mostly in your age. And, as you grow old, target-date funds robotically regulate your asset allocation for you.

Let’s have a look at an instance:

In case you plan to retire in about 30 years, a very good goal date fund for you is likely to be the Vanguard Goal Retirement 2050 Fund (VFIFX). The 2050 represents the yr during which you’ll possible retire.

Since 2050 continues to be a methods away, this fund will comprise extra dangerous investments similar to shares. Nevertheless, because it will get nearer and nearer to 2050, the fund will robotically regulate to comprise safer investments similar to bonds, since you’re getting nearer to retirement age.

These funds aren’t for everybody although. You might need a unique degree of threat or totally different objectives. (At a sure level, you might need to select particular person index funds inside and out of doors of retirement accounts for tax benefits.)

Nevertheless, they’re designed for individuals who don’t need to fiddle with rebalancing their portfolio in any respect. For you, the benefit of use that comes with lifecycle funds may outweigh the lack of returns.

Conclusion

As an investor, it’s by no means smart to place all your eggs in a single basket. The secret is to search out the proper technique, whether or not that’s specializing in one asset class and going all-in on a variety of investments inside that class or spreading out your investments throughout all asset lessons.

Both sort of funding technique can assist scale back the chance whereas rising the probabilities of rewards, which is what investing is all about. Ensure you do your analysis and have the proper method on your wants, and you need to be capable to reap the advantages {that a} well-diversified portfolio affords.

100% privateness. No video games, no B.S., no spam. While you enroll, we’ll preserve you posted

[ad_2]

Leave a Reply