[ad_1]

Discovering the precise financial savings account can get you an additional $200 without spending a dime this 12 months.

Relying in your stability, it may make you much more cash.

Let’s say you may have $10,000 to place into the most effective on-line financial savings account.

How a lot would that flip into at a giant financial institution financial savings account? Most massive banks have an APY (annual share yield) of 0.15% or much less. After a 12 months, your account can be value $10,015. Not a lot of a achieve there.

I really like getting cash for nothing, however even I’ve a tough time getting excited over an additional $15.

Now let’s say you are taking that very same $10,000 and put it into an internet high-yield financial savings account with an APY of two.25%.

After a 12 months, you’ll have $10,225.

That’s $225 for doing completely nothing. Everybody wants some additional money available for an emergency fund anyway. Why not get as a lot as you’ll be able to whereas it sits there? All it takes is opening the precise account.

The very best on-line financial savings accounts

We’re going to do a deep dive into what to search for, which accounts are greatest, how one can get the best APY, and tips for optimizing your financial savings accounts.

Right here’s a breakdown of what we’ll cowl:

What Issues When Selecting an On-line Financial savings Account:

- Person Expertise and Firm Fame

- Charges

- Comfort

- FDIC Insurance coverage

- APY Charges

On-line Financial savings Account Opinions:

The 4 Step Course of to Selecting an On-line Financial savings Account

If you wish to skip all of that and open an account proper now, these excessive curiosity on-line financial savings accounts had been our prime rated:

You’ll be proud of any of them. My private favourite is Ally.

What issues when selecting an internet financial savings account

Right here’s how we consider these accounts.

Person expertise and firm repute

Good on-line and cellular apps make an enormous distinction as of late, but it surely doesn’t matter as a lot whenever you’re in search of a excessive curiosity on-line financial savings account.

It must be ok however not nice.

Why?

As a result of we not often log into financial savings accounts. They often have limits of with the ability to withdraw from them as much as 6 occasions per thirty days. By definition, they’re not meant for use recurrently.

Having fast and easy accessibility to your funds is much less vital than working with an organization that has a dependable repute.

Whereas most prospects can entry their high-interest fee accounts rapidly in an emergency, not all monetary establishments are created equal. We skipped firms that scored lower than 65 p.c of the Harris Ballot Company Fame Rankings like Wells Fargo, Goldman Sachs, and Financial institution of America. We additionally factored in main scandals during the last 5 years.

Charges

For on-line financial savings accounts, it’s completely important that you just get an account with none upkeep charges. Month-to-month upkeep charges was once widespread. Fortunately, most accounts have executed away with them.

On any good financial savings account, you’ll not often run into charges throughout regular utilization. However even on the most effective accounts, it’s attainable to set off charges for sure occasions:

- Returned deposit objects

- Overdraft objects paid or returns

- Extreme transaction payment (like going over 6 withdrawals per thirty days)

- Expedited supply

- Outgoing home wires

- Account analysis charges

We’ve made certain to not embrace any banks in our checklist which have upkeep charges. However you have to be conscious of a few of these different payment objects that do exist on each account.

Comfort

What we contemplate to be “handy” with financial savings accounts falls into two buckets relying on the place you might be in your personal private finance journey.

While you’re constructing financial savings for the primary time, it’s important to get an account with no minimal stability requirement. A $5 required stability or one thing like that’s effective, you simply don’t wish to have to fret a couple of greater one.

Don’t put up with any account that requires a large minimal stability. There are such a lot of choices that don’t have any stability necessities in any respect. That is the very last thing you have to be fearful about within the early days, particularly if an emergency comes up and you should withdraw money.

In a while, what you contemplate to be handy usually modifications.

When you’ve constructed sufficient of a money buffer for your self, you’ll care so much much less about minimal balances. As a substitute, your accounts, playing cards, and banks have all gotten difficult sufficient that simplicity issues much more than it used to. At this stage, some of us will go for a decrease APY with the intention to consolidate their accounts and make all the things extra manageable.

Is that this the optimum technique to get each ounce of progress out of your money? No, it isn’t. However the additional piece of thoughts will be nicely value the price. If this sounds interesting to you, test to see if the financial savings account at your predominant financial institution has a ok APY with none upkeep charges. If it does, it could possibly be the best choice.

FDIC insured

Don’t ever contemplate an internet financial savings account that’s not FDIC insured. Because of this the account is assured by the federal authorities as much as $250,000 per depositor. If one thing horrible ought to occur to the financial institution, the federal authorities ensures you’ll nonetheless get entry to your stability, as much as $250,000. That is per depositor, so the $250,000 contains the mixed stability of all of your financial savings accounts on the similar financial institution.

Nearly each financial savings account is FDIC insured. It’s been a normal follow for a very long time. However hold a detailed eye on this any time you’re contemplating an progressive or distinctive strategy to storing your money.

For instance, some of us will retailer their money in a cash market account, which operates so much like a financial savings account. Cash market accounts are often FDIC insured. However cash market funds, which you place money into from a brokerage account, will not be FDIC insured. A delicate but vital distinction throughout tenuous occasions.

One other instance: Robinhood tried to roll out a checking account that promised a 3% APY. That’s a checking account paying greater curiosity than any financial savings account that was out there on the time, by virtually 1%. Sounds superb proper?

It got here with plenty of catches, one in every of which was that it wasn’t FDIC insured. With out the FDIC insurance coverage, we don’t contemplate the upper APY well worth the danger.

Our stance is that each greenback of our financial savings ought to be coated by the FDIC, even when the stability is excessive sufficient that we’ve got to separate it up between a number of financial savings accounts.

The entire accounts that we evaluate under are FDIC insured. Simply hold a watch out for this if you happen to’re exploring an atypical strategy to storing your money.

APY charges

APY charges — the annual share yield — are the primary distinction between financial savings accounts. The upper your APY fee, the extra money that you just get mechanically each month.

APY charges throughout saving accounts usually fall into 3 tiers.

Huge financial institution financial savings account APYs

For the overwhelming majority of huge financial institution financial savings accounts, the APY is horrible. Huge banks assume that you really want a financial savings account alongside along with your checking account, so that they don’t do something to entice you for the financial savings account itself. Even when loads of on-line high-yield financial savings accounts are providing an APY of two%, massive banks would possibly solely provide a 0.15% APY. On a financial savings stability of $10,000, that’s a distinction between making $200 a 12 months versus $20 a 12 months.

This doesn’t apply to ALL massive banks, however most of them do fall into this class. So hold a watch out for these. Until you actually wish to maximize comfort by consolidating accounts and taking a decrease APY, it’s value discovering an account with a better APY.

Excessive yield financial savings account APYs

Excessive yield financial savings accounts have grow to be extraordinarily fashionable. These banks don’t have branches, they’re 100% on-line. Since save so much from not having bodily places, they move the financial savings onto you with a better APY.

Ally and American Specific are two of the most well-liked banks on this class.

The APY additionally stays up to date over time. Again throughout the monetary disaster, the Federal Reserve dropped rates of interest to 0% and most excessive yield financial savings accounts had APYs of 0.5-0.7%. Because the Federal Reserve elevated rates of interest, these similar accounts additionally elevated their APY. Each time rates of interest enhance, you’ll get these will increase mechanically from these accounts. No have to continually swap between accounts and chase the most effective fee.

Innovative APYs

At any given second, there are a couple of banks which might be pushing the APYs greater than anybody else. They’re doing this as a promotional technique to draw extra prospects. A few of these banks hold tempo with altering rates of interest, a few of them don’t.

Whereas we don’t contemplate it well worth the effort to chase an additional 0.1% on our APY, these banks are an choice if you happen to’re seeking to maximize the APY in your financial savings.

On-line financial savings account evaluations

Right here’s the lowdown on the most well-liked on-line financial savings accounts.

Axos financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.30%

The APY is far decrease than different high-yield financial savings accounts — it’s common at greatest. There’s no cause to open an Axos account until you’ve already maxed the FDIC limits on each different high-yield financial savings account and should get a decrease APY to horde all of your money.

I like to recommend selecting one of many different accounts from this checklist.

Uncover on-line financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.60%

Uncover’s APY is fairly sturdy. Not fairly the highest, but it surely’s actually shut.

And if you happen to occur to have a Uncover card or checking account, maintaining your accounts in a single place makes all the things so much easier.

If in case you have one other Uncover account, positively get a Uncover financial savings account.

HSBC

HSBC has a couple of completely different financial savings accounts.

HSBC Premier Financial savings

- FDIC insured: Sure

- Minimal stability: $100,000 throughout your deposit accounts and funding balances. If you happen to go under this stability, there’s a $50 month-to-month payment.

- Upkeep charges: None

- APY: 0.15%

The HSBC Premier accounts are for purchasers who’ve giant deposits at HSBC. Sadly, the APY is terrible. An APY that low with a minimal stability of $100,000 is form of insulting.

This can be a good instance of a basic massive financial institution financial savings account. A bunch of constraints with a horrible APY. Skip these accounts fully.

- FDIC insured: Sure

- Minimal stability: $1

- Upkeep charges: None

- APY: 1.85%

HSBC does have a high-yield financial savings account with a aggressive APY. Usually, I’d suggest this account as a predominant contender.

However HSBC is only a horrible financial institution. Each interplay with them is harder than it must be. The one cause I’d ever contemplate opening an HSBC account if I wanted a large, worldwide financial institution for some cause.

Though this account seems to be nice on paper, you’ll remorse it in case your expertise is something like ours.

Ally financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.6%

We’re big followers of Ally. They’ve grow to be one of many main high-yield financial savings accounts.

Sure, Ally doesn’t technically have the best APY, but it surely’s darn shut. And so they replace their APY typically. So if rates of interest proceed to rise, you’ll get a better APY with out having to do something.

Their account UI is fairly slick too, and it’s all the time bettering.

I’ve an Ally account myself.

Be happy to cease studying right here and open an Ally account proper now. You gained’t remorse it.

Capital One 360 Financial savings

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.7%

Capital One used to have an APY that lagged the remainder of the market, making it a sub-standard selection. You’d have to make use of one other financial institution or their Capital One 360 Cash Market account to get a aggressive APY.

Now they’ve an APY that’s simply nearly as good as most banks. It’s one of many prime contenders.

Particularly when you’ve got Capital One bank cards, it’s very nice to maintain all the things at one financial institution.

Marcus by Goldman Sachs

- FDIC insured: Sure

- Minimal stability: None, however there’s a deposit restrict of $1,000,000 for all of your financial savings account and CDs

- Upkeep charges: None

- APY: 1.7%

Goldman Sachs jumped into the high-yield financial savings account house with one of many highest APYs.

They do restrict deposits to a complete of $1,000,000, however that’s not a serious concern. You’ll wish to break up up your money balances throughout a number of banks to get all of it FDIC insured anyway.

If you happen to’re in search of your first high-yield financial savings account, it is a implausible choice.

American Specific financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.7%

American Specific was one of many first to introduce a high-yield financial savings account, and it’s been round for awhile now.

Today, the APY is barely decrease than a number of the rivals. Whereas American Specific does replace their yields continuously, they’re all the time 0.10-0.20% off the best charges. Whereas it’s nonetheless an awesome choice, I’d select one of many different accounts for that reason alone.

One different caveat: the American Specific financial savings account isn’t built-in into the identical login account because the American Specific bank cards. Even when you’ve got each, it appears like having two completely different banks. There’s no additional simplicity from attempting to consolidate.

Barclays financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.7%

One other nice choice. Nice APY, no upkeep charges or minimal balances — you’ll be able to’t go incorrect with a Barclays on-line financial savings account.

Synchrony financial savings account

- FDIC insured: Sure

- Minimal stability: None

- Upkeep charges: None

- APY: 1.7%

Synchrony can also be an awesome choice. The APY is among the highest and has no minimums or upkeep charges.

Vio Financial institution

- FDIC Insured: Sure

- Minimal Deposit: $100

- Upkeep Charges: None

- APY: 1.85%

This account presents greater returns as a result of the financial institution has no bodily places. They provide a aggressive APY with a low minimal deposit. You’ll wish to look out for the $5 payment to obtain paper statements and a $10 payment for any withdrawal over the allotted six transactions per thirty days.

Comenity Direct Financial institution

- FDIC Insured: Sure

- Minimal Deposit: $100

Upkeep Charges: None - APY:1.90%

Comenity Financial institution has aggressive charges and doesn’t cost a upkeep payment. Shoppers additionally get free ACH transfers, free on-line statements, free incoming transfers, and limitless deposits on their cellular app or through ACH switch. They do cost for outgoing wire switch, official test requests, and paper assertion charges. Comenity has an interest-earning restrict on balances of $10 million.

Residents Entry

- FDIC Insured: Sure

- Minimal Deposit: $5,000

- Upkeep Charges: None

- APY: 1.85%

Whereas Citizen’s Entry does have a better minimal stability to earn curiosity, the APY may be very aggressive, they usually rank excessive for his or her CDs as nicely. Citizen’s Entry doesn’t have a cellular app they usually don’t provide any checking accounts, so that you’ll have to separate your funds between two monetary establishments.

The 4-step course of to selecting the most effective on-line financial savings account

- Test the banks that you just presently have accounts with and see if they’ve a aggressive financial savings account. If the APY is similar to the accounts we listed above, stick along with your present financial institution.

- In any other case, decide an account from this checklist:

- Attempt to decide an account from a financial institution that you just foresee doing different enterprise with. For instance, Ally has automotive loans and Uncover has their bank cards.

- If you happen to’re nonetheless undecided, go together with Ally.

What about sub-savings accounts?

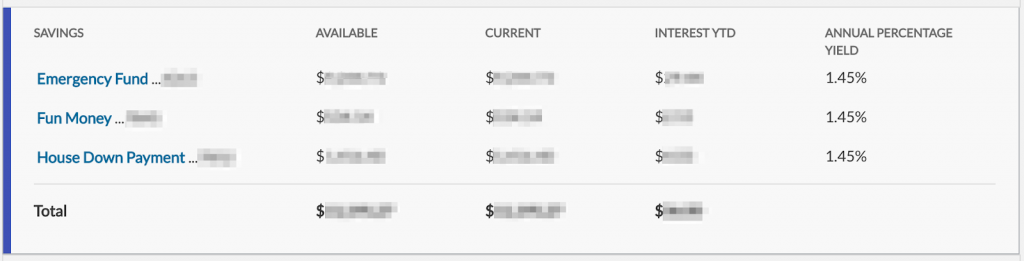

One in every of our favourite financial savings account tips is to open “sub-accounts.” This enables us to simply finances for greater purchases by saving somewhat bit every month. We are able to additionally monitor all the things by separating all of the accounts.

For instance, I’ve these classes in my very own financial savings account:

- Emergency fund

- Home downpayment

- Mini-retirement

- Christmas presents

- Annual trip

Every month, cash goes into every of those separate accounts with the automated transfers that I arrange. And I can simply see how a lot I’ve saved in direction of my targets.

Ramit’s financial savings accounts used to seem like this again earlier than ING Direct was purchased by Capital One:

Right here’s a extra present instance in Ally:

Some financial savings accounts will name these “sub-accounts,” and all the things can be a part of the identical financial savings account. This can be a uncommon function to seek out although.

For everybody else, merely open up a number of financial savings account beneath the identical financial institution login. You possibly can simply have 5-10 accounts on the similar financial institution. Then deal with every account for no matter saving class that you just like.

This implies you may get “sub-accounts” at any financial institution, even when they don’t have a “sub-account” function.

Don’t chase yields

Look, there’s all the time a financial institution that has a barely greater APY. Banks use it as a promotion technique to get extra accounts, so it’s all the time altering.

Usually researching new APY charges, in search of that additional 0.05% APY, opening accounts, and transferring cash in every single place wastes extra time than it’s value.

Don’t be a fee chaser.

Bear in mind IWT’s philosophy of huge wins. Give attention to the key wins that actually transfer the needle and overlook concerning the small stuff. Chasing greater APYs on financial savings accounts positively falls into the “small stuff” class.

Decide a financial savings account that has a aggressive APY from a financial institution that you just belief for the long run. Then persist with that call and work on bettering different areas of your life.

Cash market accounts vs financial savings accounts

The distinction between cash market accounts and financial savings accounts will be fairly complicated.

That’s as a result of there’s no sensible distinction.

Listed here are the similarities:

- The APY tends to be the identical between each sorts of accounts.

- You possibly can withdraw as much as 6 occasions per thirty days.

- Some have ATM playing cards, some don’t.

- Some have minimums, some don’t.

- Each are FDIC insured.

Principally they’re the identical account. In case your financial institution occurs to supply a cash market account with no upkeep charges, no minimal, and a aggressive APY, be at liberty to make use of it.

Now for the complicated half: cash market funds are fully completely different. They’re a part of brokerage accounts and assist you to place money when you wait to speculate it. Since cash market funds will not be FDIC insured, so it’s not a very good behavior to retailer masses of cash in them.

When to get financial savings accounts from a number of banks

If you happen to ask excessive web value of us which financial savings accounts they’ve, generally they’ll checklist off half a dozen completely different banks.

At first, this is unnecessary. Why all the additional complexity and completely different accounts?

There’s one cause: FDIC insurance coverage limits.

Most individuals are restricted to $250,000 value of insurance coverage at any given financial institution. Joint accounts and accounts throughout completely different classes (like retirement accounts) can enhance this restrict, however that solely goes to date. If in case you have a considerable amount of money, the one approach to hold it insured is to open up financial savings accounts throughout a number of banks.

That’s why of us will begin opening up financial savings accounts throughout a number of banks.

If in case you have a number of financial savings accounts to handle, Max will mechanically transfer balances round your accounts to optimize for the best APY whereas maintaining all of your money insured. They do cost a 0.08% annual payment for the service.

As for which accounts to open, we suggest beginning with these:

Any mixture of accounts which have sturdy APYs will work.

[ad_2]

Leave a Reply