[ad_1]

The Financial institution of Russia acted shortly to defend the nation’s $1.5 trillion economic system from sweeping sanctions that hit key banks, pushed the ruble to a document low and left President Vladimir Putin unable to entry a lot of his struggle chest of greater than $640 billion.

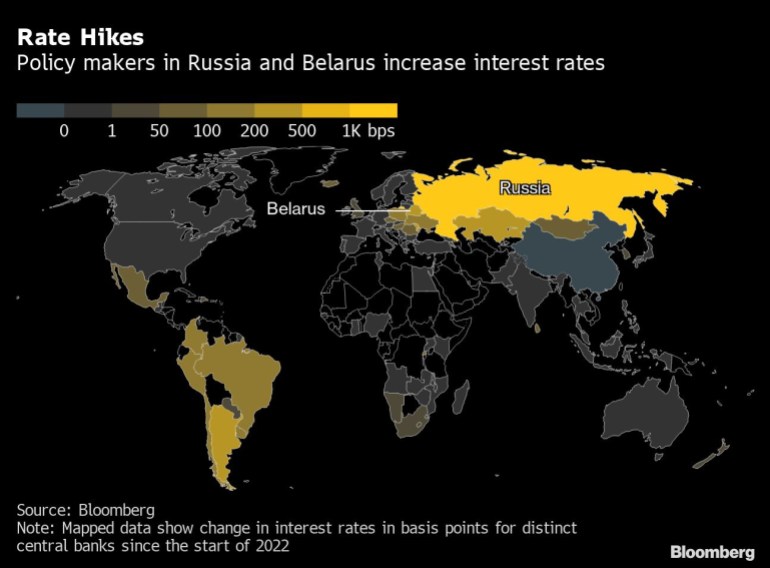

The central financial institution greater than doubled its key rate of interest to twenty%, the very best in nearly 20 years, and imposed some controls on the movement of capital. It was a part of a barrage of bulletins that finally restored some calm after a rout that pushed some Russian Eurobonds into distressed territory final week.

“The Financial institution of Russia will likely be very versatile in utilizing all essential devices,” Governor Elvira Nabiullina stated in short televised remarks in Moscow.

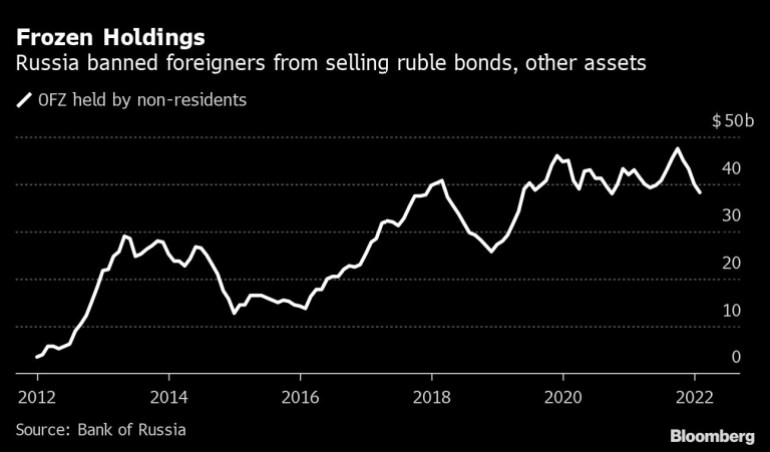

Dealing with the chance of a financial institution run, a speedy sell-off in property and the steepest depreciation within the ruble since 1998, coverage makers banned brokers from promoting securities held by foreigners beginning Monday on the Moscow Trade. Exporters had been ordered to start out necessary hard-currency income gross sales and inventory buying and selling was quickly suspended in Moscow.

“The ruble has ceased to be a freely convertible forex with the sweeping sanctions,” stated Friedrich Heinemann, head of the company taxation and public finance division at German suppose thank ZEW. “By way of forex coverage, this throws Russia again to the early Nineties and the time earlier than the nation’s complete financial opening.”

Lower than per week after Putin ordered his navy to invade Ukraine, Russia is liable to succumbing to the most important monetary disaster of his greater than 20 years in energy. He gathered Nabiullina and different high officers within the Kremlin to debate plans for a response, calling the U.S. and its allies who joined within the sanctions “the empire of lies.”

The steps taken to this point on Monday signify essentially the most forceful measures by Russia after the most recent spherical of sanctions, with the U.S. and the European Union agreeing to dam entry to a lot of the $640 billion the nation’s central financial institution has constructed up as a buffer to guard the economic system.

Extra measures taken by international governments to exclude some Russian banks from the SWIFT messaging system may additional choke up the nation’s banking system. Sanctioned establishments dominate Russia’s monetary sector with $1 trillion in property.

However the U.S. and Europe stay reluctant for now to sanction Russian power, looking for to insulate the world economic system from a better shock. Germany’s Financial system Ministry stated on Monday that purchases of Russian gasoline stay potential utilizing SWIFT even after the most recent curbs.

Within the absence of even wider commerce sanctions that would ensnare Russian power shipments, the insurance policies applied to this point could also be sufficient to stabilize markets, in line with Renaissance Capital. The ruble recouped some losses and was buying and selling almost 14% weaker at round 96 per greenback as of 4:26 p.m. in Moscow. It was briefly down greater than 30% earlier within the day.

“All these measures ought to restrict the depreciation of the ruble,” stated Sofya Donets, economist at Renaissance Capital in Moscow. “If the run on FX continues, we might anticipate further direct restrictions on home operations.”

Nabiullina, who took no questions from reporters on Monday, stated the central financial institution didn’t intervene within the forex market on Monday because of the constraints on its reserves. It spent $1 billion final Thursday and a smaller quantity the next day to shore up the ruble, she stated.

“We’ll make additional choices on financial coverage based mostly on how the precise scenario develops whereas assessing dangers primarily by way of the exterior situations,” Nabiullina stated.

Selections to droop some regulatory necessities amounted to a capital increase for banks by the equal of 900 billion rubles ($8.6 billion), she stated.

The ruble’s 24% drop to this point this yr is the worst hunch globally, costs compiled by Bloomberg present. At present ranges the ruble’s hunch is the most important since 1998, the yr the nation’s economic system went right into a tailspin and the federal government defaulted on its native debt.

S&P International Rankings lowered Russia’s credit score rating under funding grade on Friday, whereas Moody’s Traders Service — which charges Russia one notch above junk — put the nation on overview for a downgrade.

Coverage makers are counting that the steep charge hike, alongside the necessary conversion of export revenues and a halt to outflows from the monetary market, will assist restore confidence and reduce losses at house at the same time as struggle continues to rage throughout the border.

“That is merely a response by the central financial institution to the truth that sanctions have weakened, fully neutralized their protection arsenal that they’ve constructed up previously 5 to 10 years,” stated Simon Harvey, head of FX evaluation at Monex Europe Ltd. “It’s unprecedented escalation and markets are very poorly positioned for it.”

Russians had been already lining up at money machines across the nation as demand for international forex soared. The central financial institution has stated it was rising provides to ATMs to satisfy want and issued one other assertion Sunday vowing to offer banks “uninterrupted” provides of rubles.

Most of Europe has closed its airspace to Russian carriers, which may make it tough to bodily transport money into the nation.

“I feel rubles will likely be lots, the query is FX,” stated Viktor Szabo, an investor at Aberdeen Asset Administration Plc. in London. “With reserves partially blocked, the central financial institution must prioritize, and I assume inhabitants won’t be on high of the checklist.”

Oil and gasoline income stays a lifeline because the sale and transport of power have largely escaped disruptions. At present costs, Russia was operating a month-to-month current-account surplus of about $20 billion.

Nonetheless, injury to the economic system will likely be extreme from the mix of untamed swings within the alternate charge and the hovering value of cash. Bloomberg Economics was already predicting a contraction within the first and second quarter even earlier than the weekend’s sanctions and now sees the chance of a good “deeper downturn.”

Renaissance Capital stated it now expects a recession this yr, in comparison with a forecast of three% development anticipated as not too long ago as final week.

The continued movement of oil will seemingly present some reduction, given the World Financial institution calculates commodities account for nearly 70% of products exports. About 43% of the nation’s crude and condensate output is bought overseas.

If crude costs keep round $90 this yr, the nation’s price range may get greater than $65 billion in further income, including to the Kremlin’s monetary power, economists stated not too long ago. Oil at $100 would increase the windfall nearer to $73 billion.

In Russia, recollections linger of hyperinflation that peaked at greater than 2,500 p.c in 1992 and worn out financial savings within the wake of the Soviet collapse. Worth development is already operating at greater than double the central financial institution’s goal, regardless of a sequence of charge hikes since final March.

Renaissance Capital estimates the suspension of operations with non-residents alone may forestall $50 billion in potential capital outflows within the coming weeks. The freeze on such transactions might keep in place for lengthy, in line with RenCap’s Donets.

“These measures might assist settle down the elevated market nervousness, however on the similar time they undermine the muse of financial coverage, which is concentrated on inflation concentrating on and a versatile alternate charge,” stated Natalia Lavrova, chief economist at BCS Monetary Group in Moscow. “We don’t rule out a potential charge hike going ahead or additional surprising and non-market choices.”

(Updates with governor’s feedback beginning in third paragraph.)

[ad_2]

Leave a Reply